4 Things to Always Include in Your Capital Plans

Capital planning demands are constant and ever-growing. Finance leaders must ensure investments align with productivity, profitability, and sustainability goals, all while navigating immediate challenges like aging infrastructure, maintenance delays, shrinking budgets, and compliance demands.

Relying on guesswork is simply not an option.

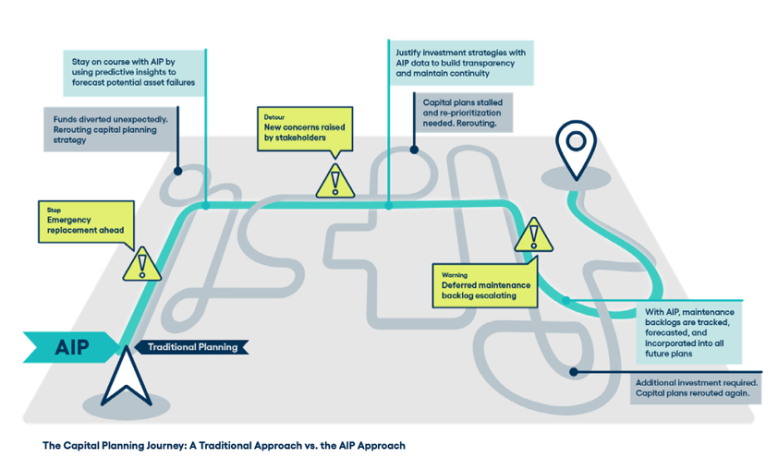

Outdated methods like manual data entry, spreadsheets, outsourcing, and reactive maintenance are like using a paper map for a road trip – they can work, but often lead to inaccurate forecasting, missed opportunities, and the risk of unexpected breakdowns or asset failures.

An ongoing Asset Investment Planning (AIP) strategy is pivotal to making informed capital planning decisions well before you hit a “roadblock.” By analyzing real-time data on asset conditions, maintenance history, and potential risks, finance and operations leaders can work together to ensure capital plans maximize ROI while reducing downtime and avoiding emergency repairs.

With a structured approach and the right data, you can assess, prioritize, and manage investments more effectively. Here are the four key components to always include in your capital plans to ensure long-term success.

1. Asset condition data

Without a clear understanding of asset conditions, it's nearly impossible to make informed decisions around repairs, replacements, and upgrades. Asset condition data provides a comprehensive view of which assets, facilities, or critical pieces of infrastructure need immediate attention – and which still have life left. By consolidating this data into a modern CMMS, you can gain insights into maintenance trends, inventory needs, asset usage, remaining lifecycles, and more – all of which support smarter long-term capital planning.

Facilities condition assessments

One way to gain this data is through a facilities condition assessment (FCA). An FCA is an in-person or third-party evaluation of your facilities and assets, that provides a clear picture of their current health and remaining useful life. This data can be invaluable for making informed decisions on where to allocate your resources most effectively and ensures decisions are not made based on outdated or inaccurate information.

But the benefits of an FCA go even further – this data can provide the hard evidence necessary to secure additional funding for critical repairs or upgrades. For instance, it helped the city of Asheville, NC secure an additional $3.5 million for its capital plans to support critical preventive maintenance. Incorporating FCA data into your capital plans ensures that investments are aligned with actual asset conditions, helping you stay ahead of repairs and allocate resources strategically.

2. Maintenance records

By examining your maintenance history, you can identify where overspending has occurred and where cost savings have been achieved. This data can reveal key trends and patterns that inform decisions on whether to repair or replace assets, helping you avoid costly breakdowns and allocate resources more effectively. Unplanned asset failures are a major cost driver for organizations. According to Siemens research, the world’s largest 500 companies lose 11% of their annual revenue – roughly $1.4 trillion in total – due to unplanned downtime.

This is why proactive maintenance and data-driven decision-making are critical in capital planning. Detailed maintenance records go beyond improving day-to-day operations – they provide invaluable insights that help organizations plan for the long-term and avoid any surprise roadblocks that require emergency repairs and reallocated funding. By incorporating these records into your capital strategy, you can identify potential risks early, extend the lifespan of your assets, and ensure investments are being made in the right places.

3. Risk and criticality assessments

By understanding the likelihood of asset failure and the criticality of each asset on daily operations, you can make more informed decisions on how to plan and allocate capital funds. Knowing which assets are most at risk, and more importantly, which are essential to keeping operations running smoothly, helps ensure that capital investments are always strategically prioritized.

Tools like Asset Investment Planning (AIP) software make this easier than ever by analyzing asset data to determine the likelihood of failures alongside their importance to operations. Modern AIP solutions can model these factors to help prioritize investments and ensure that the needs of your most critical assets are addressed first, while lower-priority assets can be deferred.

With AIP software, your organization can make more informed, data-driven capital plans, justify capital expenditures, and allocate funds more effectively.

4. Feedback from key stakeholders

Including feedback from stakeholders across multiple departments is crucial to creating effective capital plans that align with operational needs, financial limitations, and broader organizational goals. This also provides valuable insights into daily challenges, user requirements, and potential concerns to help decision-makers proactively address issues before they escalate and foster a cohesive strategy across your entire organization.

External feedback – from customers, investors, and regulatory bodies – is also crucial to include in capital plans, as these play a key role in ensuring that investments not only meet compliance standards but also address market needs, account for consumer expectations, and ensure long-term relevance.

The importance of AIP for capital planning readiness

With the challenges facing facilities today – aging infrastructure, rising costs, limited funding, and growing compliance demands – decision-makers can simply no longer fall back on outdated capital planning methods. Finance and facilities leaders must be able to factor in potential bumps in the road ahead of time or risk expensive delays and diversions.

AIP software is like a strategic “GPS” to help you forecast “roadblocks” and necessary “detours” long in advance. Modern AIP solutions can guide your capital planning and maintenance strategies with continuous data analysis on the condition, cost, risk, and value of your assets, so you can find the most direct, cost-effective route to take.

Conclusion

By incorporating asset condition data, facilities condition assessments, maintenance records, risk and criticality assessments, and stakeholder feedback, organizations can ensure their capital plans are aligned with actual needs, risks, and long-term goals. And having a modern “GPS” to guide capital planning and maintenance is crucial for responding to change with agility and getting the most value from your asset data.

By adopting a structured, data-driven approach to capital planning with tools like AIP software, you set the stage for long-term success, enabling your organization to navigate challenges with confidence, avoid disruptions, and make smarter decisions for the future.