Strengthen Your Real Estate Portfolio with ESG: A Guide to Sustainable Success

Shifting market and non-market conditions are continually creating new risks and opportunities in commercial real estate. Property owners and landlords face three key areas of sustainability: environmental, social, and governance (ESG). Each has strategic value in protecting and growing portfolios in today’s rapidly changing world.

Adopting ESG strategies can help organizations improve reputation and culture, reduce risk, and identify new opportunities for energy savings. Strong ESG practices can also increase asset value, cut costs, and create access to sustainable financing, making it a valuable strategy for nearly any organization today.

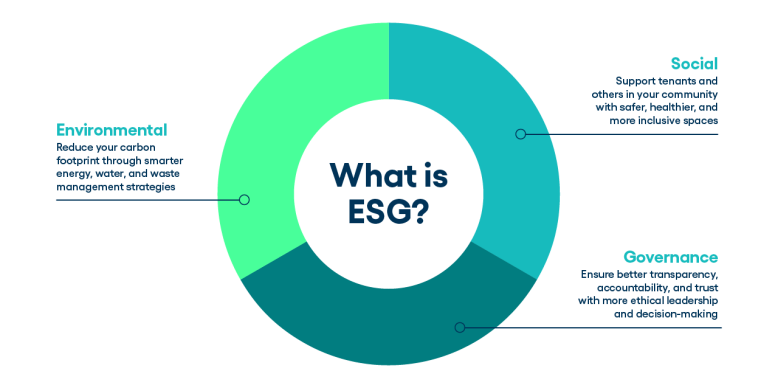

What is ESG?

ESG is the standard for measuring a company’s commitment to sustainability. Performance in each area affects risk management, operating costs, and portfolio strength.

- Environmental criteria refers to the environmental impact and stewardship a company has. Environmental building factors typically include a property's carbon footprint and address energy consumption, water usage, and waste management.

- Social criteria are how the company manages relationships with and creates value for stakeholders.

- Governance criteria deal with a company’s leadership and management philosophy, practices, policies, internal controls, and shareholder rights.

Each of these factors directly impacts and influences a property’s long-term value and performance. But though it’s agreed that these three factors are key in their impact on a business portfolio, there is no universal categorization for ESG issues, which sometimes makes them a challenge to maintain and measure.

Environmental criteria

Environmental criteria in commercial real estate is increasingly tied to long-term asset resilience. Climate change drives more frequent extreme weather events, while stricter regulations and community expectations place greater pressure on owners to improve efficiency and reduce emissions.

For example, properties in flood zones or storm-prone regions carry higher risks of physical damage and downtime. Water scarcity raises costs for buildings that rely on irrigation or cooling. And energy-intensive sites such as data centers face higher exposure to volatile energy prices and scrutiny over carbon emissions.

Beyond risk mitigation, environmental strategies also drive value creation. Energy-efficient systems, sustainable construction materials, and waste reduction programs lower operating expenses and attract tenants seeking greener spaces. For investors, strong environmental practices are now a sign of responsible stewardship and future-proofed assets.

Social criteria

The “S” in ESG is often the hardest to measure, but it plays a central role in improving an company’s reputation and tenant satisfaction. Social factors include ways that a property serves its occupants, employees, and surrounding community. Buildings that prioritize safety, accessibility, and health deliver direct benefits to tenants and employees, while properties that support local economic development strengthen trust and goodwill.

For owners and managers, this means ensuring buildings are safe, resilient, and offer amenities that improve tenant well-being. Or it could mean engaging with community organizations. Social performance can even extend to workforce practices, diversity and inclusion initiatives, and respect for human rights across supply chains.

Strong social practices reduce reputational risks and improve retention, both of which contribute to long-term portfolio stability. Properties viewed as responsible and community-minded can gain an advantage in competitive markets where tenants and investors are increasingly making decisions based on social values.

Governance criteria

Governance defines how an organization makes its decisions and upholds accountability. For commercial real estate, this includes executive compensation, board oversight, transparency, and ethical business practices. Investors and tenants alike view governance as a direct indicator of long-term stability and trustworthiness.

Strong governance means aligning leadership incentives with sustainability goals, maintaining clear reporting standards, and ensuring diverse and representative boards. It also involves enforcing compliance, protecting shareholder rights, and maintaining strong internal controls.

Weak governance, on the other hand, increases the risk of mismanagement, unethical behavior, or poor stakeholder relations, all of which can damage a company or property’s value. Strong governance practices not only build confidence with investors and tenants, they also provide a framework for executing better environmental and social initiatives effectively.

Why ESG matters in CRE

Today, ESG is no longer optional. Residential and commercial properties combined account for 31% of total U.S. greenhouse gas emissions, according the EPA, making the sectors central to sustainability goals. Increasing regulatory pressure, investor expectations, and tenant demand make ESG integration critical for long-term portfolio value.

The benefits extend beyond compliance, however. ESG initiatives reduce operating costs, increase property values, improve retention, and strengthen access to capital. Net-zero targets and green building investments are now benchmarks of responsible asset management.

Popular ESG certifications and standards

To measure and verify ESG progress, building owners should now rely on certifications and frameworks that provide recognized benchmarks. Some of the most well-known for commercial real estate include:

- LEED: Global standard for sustainable building design and operations.

- CMCP: Validates commercial property management knowledge, with emphasis on energy and waste.

- BREEAM: A UK-based standard assessing sustainable building methods.

- ENERGY STAR: Measures and tracks energy, water, and waste use across portfolios.

Global frameworks also guide disclosure and performance reporting:

- GRESB: ESG benchmarking for real estate portfolios.

- CDP: A global disclosure system for environmental impacts.

- TCFD: A framework for climate-related financial reporting.

Software solutions can help CRE owners track these certifications and frameworks to ensure better compliance, easier reporting, and more opportunities for long-term cost savings.

Conclusion

As ESG continues to shape the future of commercial real estate, organizations that embrace strong environmental, social, and governance practices will be best positioned to protect asset value, reduce operating costs, and attract both tenants and investors. But while the benefits are clear, tracking ESG performance across multiple properties can be complex and time-consuming without the right tools.

With trusted data at your fingertips, you can move from reacting to energy costs and compliance pressures to proactively managing performance and driving long-term value.